College and Your Finances

College and finances can be daunting. It's crucial to plan ahead, budget wisely, and explore scholarships and financial aid options. Prioritize understanding loan terms and repayment plans to manage debt responsibly. Taking proactive steps early can make a significant difference in your financial stability throughout and after college.

-

Budgeting for College - S&T Bank

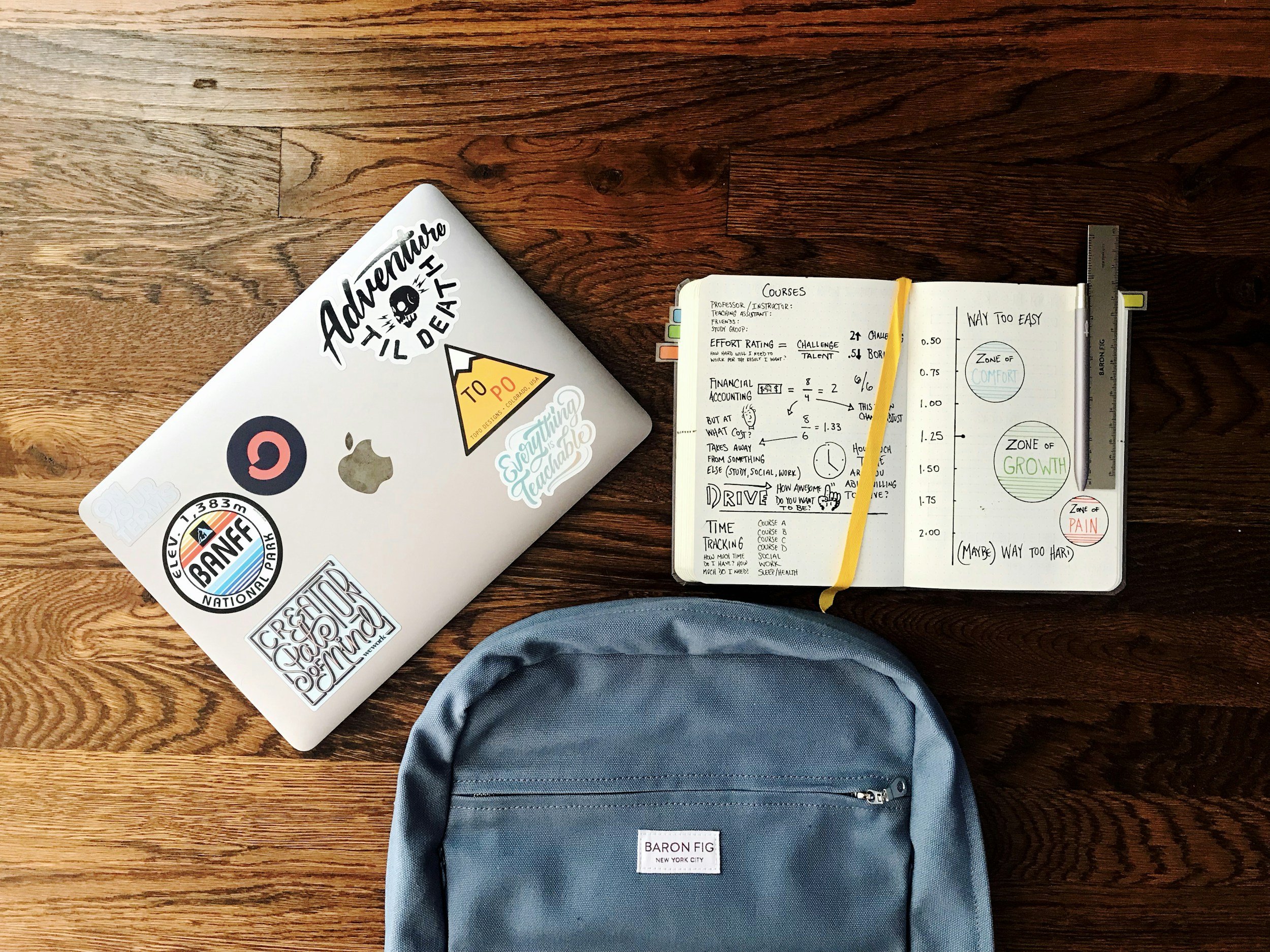

Going to college is full of expenses beyond tuition, from between-class coffee runs to weekends with your friends to printing 40 copies of your ten-page art history presentation. Budgeting for all possible expenses can give you a firm understanding of your current situation and what you can and can’t afford, allowing you to become the master of your finances.

When you’re able to anticipate your expenses and income, you can create a budget that keeps your financial goals on track.

-

6 Important Things to Know about FAFSA - S&T Bank

Each year, the U.S. Department of Education gives out more than $150 billion to help students pay for college. Don’t miss out on available financial aid. To be eligible, you’ll need to submit the Free Application for Federal Student Aid (FAFSA).

-

6 Ways to Pay for College - S&T Bank

Concerned about the cost of college? Don’t worry. You have options that can make getting a degree more affordable while avoiding big debt. From grants and scholarships and student loans to attending community college, many options are available to help make going to college more affordable. Here are six ways to pay for college if you don’t have money saved.

-

College Budget Breakdown - Mid Penn Bank

Most people ask, "How much does college cost?"—that’s the first mistake. It’s not to say this question isn’t answerable, but grouping college into one huge expense can be a little deceiving.

-

Beyond High School - PHEAA

According to the Bureau of Labor and Industry, 75% of all jobs require some type of training beyond high school. How are you going to get there? What are your options?

-

13 Questions You Should Ask Your Financial Aid Officer - AmeriChoice Federal Credit Union

Whether you’re getting ready to attend college, or you’re currently enrolled, it’s vital to utilize the financial resources available to you.